Take home pay based on hourly rate

Your salary - Superannuation is paid additionally by employer. Hourly Calculator Federal Hourly Paycheck Calculator or Select a state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the.

3 Ways To Calculate Your Hourly Rate Wikihow

To calculate your annual salary take your hourly wage and multiply it by the number of paid hours you work per week and then by the number of paid weeks you work per.

. Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand. Multiply 188 by a stated wage of 20 and you get 3760. In addition your monthly pre-tax wage would be 333333 and your weekly pay would.

KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. You will only be working for the company for six months of the year before travelling. A yearly salary of 60000 is 3077.

If your monthly pay is flat based on an annual salary then you would simply divide the salary by 12 to come up. New Zealands Best PAYE Calculator. Examples of payment frequencies include biweekly semi-monthly or monthly.

Contents Free paycheck calculator Home equity calculators -1 form 1065 Tax code box -home pay calculation deBrees tax refund went down from about 500 to 300. If you earn 40000 per year your hourly wage works out as being 1923 per hour. Take home pay 661k.

How do I calculate hourly rate. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table.

Starting July 2009 the US. 3077 per hour 5000 per months 1154 per week 2308 per 2 weeks 231 per day If you make 60000 a year how much is your salary per hour. Your salary is 60000 per year.

Enter the number of hours and the rate at which you will get paid. This is equal to 37 hours times 50 weeks per year there are 52 weeks in a year but she takes 2 weeks off. According to the Fair Labor Standards Act FLSA non-exempt employees that are covered must receive overtime pay for hours worked over 40 in a workweek at a rate not less than one.

Calculate your take home pay from hourly wage or salary. Calculate your take home. There are two options in case you have two different.

The projected total amount of annual tax you will pay is 11067. The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Paid a flat rate.

New York Hourly Paycheck Calculator. First calculate the number of hours per year Sara works. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours per week 2885 Weekly paycheck to hourly rate 1500 per week 40 hours per week 3750. Federal government allows a nationwide minimum wage per hour of 725 while depending by each states policy employers may be requested to pay higher. For example for 5 hours a month at time and a half enter 5 15.

Hourly To Salary Calculator

2022 Interior Designer Costs Charges Hourly Rates Fees To Hire

Salary To Hourly Calculator

100 000 A Year Is How Much An Hour Zippia

Mathematics For Work And Everyday Life

Hourly To Salary What Is My Annual Income

14 An Hour Is How Much A Year How To Fire

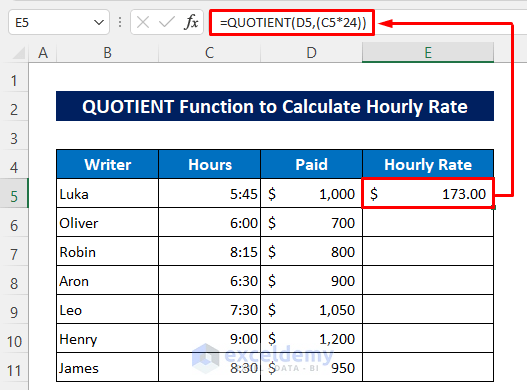

How To Calculate Hourly Rate In Excel 2 Quick Methods Exceldemy

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

2022 Handyman Hourly Rates Price List Avg Job Cost

21 Best Entry Level Jobs Paying 20 Hour Or More In 2022

Biweekly Paycheck To Hourly Wage Conversion Calculator

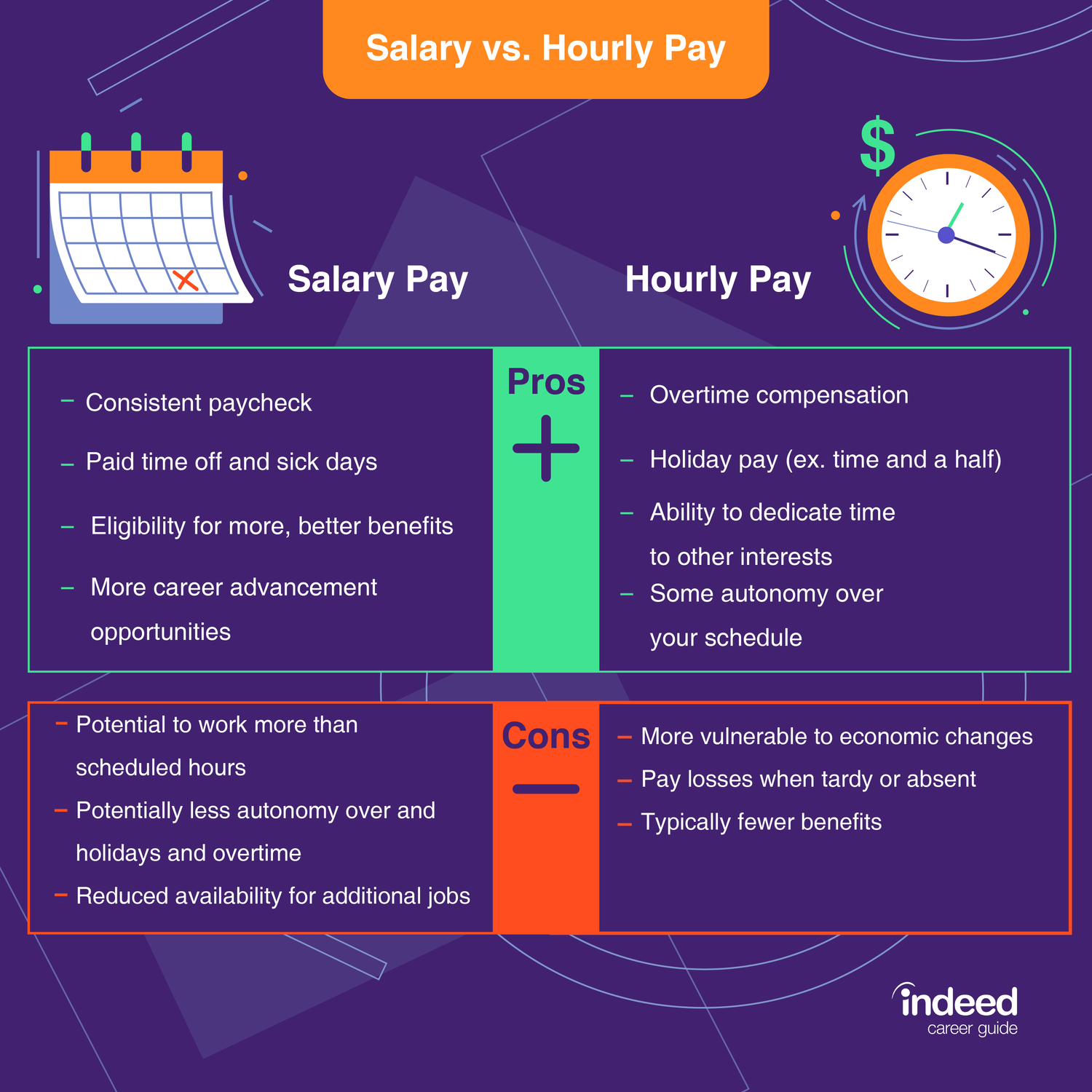

Base Salary And Your Benefits Package Indeed Com

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Annual Income Calculator